The wealth management digital transformation was not a big bang as one thought it might be or should be. While their banking brethren have undertaken a significant and radical re-architecture, the wealth management and private banking firms have largely been spectators except for a few firms dabbling in the Fintech space.

The traditional blue-blooded wealth management firms have been largely silent and on the sidelines with the hope that the typically older and wealthier clients are happy with steady as she goes style and not ready for disruptive changes in the way of rendering advisory services.

However, many factors are testing this hypothesis.

For one, the older generation is becoming comfortable and savvier in adopting the digital technologies – whether it is devices like tablets and smartphones or applications like Uber or Seamless. And this will translate into an expectation that while sitting on the couch watching TV, they could browse the portfolio on their second screen.

The newly rich are typically younger and have acquired their wealth in technology or technology-enabled services. Their lifestyles and values are not compatible with the “trust me” attitude of managing old wealth. Today’s wealth demand collaboration, transparency, and accountability.

And last but not the least, as the wealth transition from baby boomers to millennials and generations beyond occurs, it is the digitally savvy and the digital natives that will become the wealth managers’ customers.

Before we delve into the why, who, how, when, and where of the digital transformation of wealth management, let us first define the “What.”

What is digital transformation or digitalization?

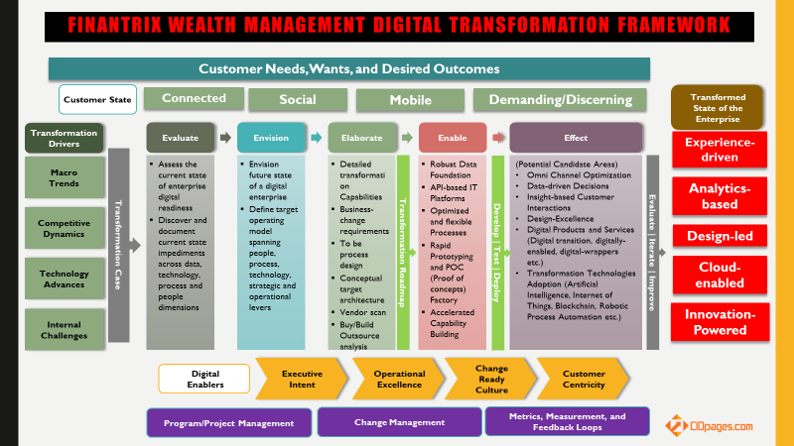

Finantrix defines digital transformation as a foundational rethinking strategy, operations, culture, product mix, revenue models of a corporation with an overarching focus on experience optimization of key stakeholders. Digital change starts with a customer-centric culture, a cloud-enabled infrastructure, analytics-driven operations and decision-making, an omnichannel optimization, engagement across the social media spectrum, and an embrace of mobile-first paradigm. Digital Transformation involves a foundational restructuring of people, operating model, processes, data, capabilities, and technology. Digitalization, at its core, is not just a technology transformation, but a total business transformation.

What this means for the wealth management and private banking firms is that the task on hand is not about changing one process, replacing or adding a few people, and it is not about implementing yet another technology solution. But the digital wealth managers of tomorrow will be a lot different than the paradigms of the past.

Why should Wealth Managers and Private Banks embrace digitalization of advice?

It is evident business-as-usual is not the answer for wealth firms. They must embrace the digitalization of wealth both as an opportunity and a threat.

The Fintech Revolution: Unless one is living under a rock, the types of upstart startups have proliferated across the wealth management value chain. Unbundling of the traditional end-to-end value chain, disintermediation, mash-up of services, and awesome experience as the overlay have been the hallmarks of the new generation Fintech startups in the digital advice realm.

In the PFM (Personal Financial Management) space, one can go back to the emergence of Mint.com as the advent of the Fintech revolution. (Intuit the makers of TurboTax and QuickBooks acquired Mint.com.) Using Yodlee as the underlying aggregation engine, Mint.com has provided a layer of summarization, synthesis and simple advice that made it the darling of consumers and envy of the established financial services players.

In the so-called Robo advisory space, firms like Betterment, WealthFront, Sigfig, Future Advisor have blazed a new trail. Taking what has been the bread and butter service of financial advisory and wealth management firms, these robo advisors have made the process of asset allocation determination, portfolio selection, and ongoing rebalancing accessible and attainable to everyone. No arcane questions, no lugging around tax and financial statements, and no complex product pitches. Simple, straightforward, seamless and at the same time sophisticated.

Companies like Kabbage, Sofi and others have rewritten the rules of underwriting for personal and commercial loans making the loan origination and issuance process a breeze.

Robinhood took the concept of no-fee transactions and rode to the status of a unicorn in a short period.

These are but a few examples of the Fintech revolution underway. While most of the Fintechs are direct to consumer, there are others that are providing a B2B2C paradigm (business to business to consumer).

Wealth management and private banking firms must pay heed to these players and the innovative ways they are solving intractable problems.

Rising Customer Expectations: The fanatical service ethos of online giants, the flexible terms regarding shipping and returns, the seamless omnichannel experience, and 24/7 availability are something every customer has been experiencing.

When one can hail a cab with a few clicks, stream a movie in any room, order and reorder goods from voice-enabled assistants, and browse a million cars to pick the right one without ever stepping on to a dealer lot, the customers are not going to cut too much slack to the wealth managers, financial advisors, and the private banks who serve them.

Technological Advances: The increase in bandwidth and the ubiquity of internet access combined with the advent of touch-enabled smartphones are the tipping points for the digital transformation. Today, smartphones have become an integral part of most people’s lives, and they love to socialize, shop, seek information, and transact using their phones.

Technologies such as chatbots and conversational AI (artificial intelligence) have led to a scalable way of engaging millions of customers with building a big call center.

RPA (Robotic Process Automation) has allowed companies to automate routine tasks thus reducing the drudgery of data entry.

Machine learning and cognitive technologies, though nascent and evolving, have been useful in collating vast amounts of data to find the nuggets of wisdom to make the advisor interactions with clients better and productive.

Predictive analytics has been a great boon in analyzing the customer actions, interactions, and behaviors to predict churn rates.

However, the wealth management digital transformation is not just about technology. While the technologies are excellent enablers, the leadership, strategy, culture, business and operating models are the crux of successful digitalization efforts.

Competition from Tech Giants: Hitherto, wealth managers and private bankers feared competition from similar companies. Or a giant bank or an asset manager tiptoeing into the advisory space. Today, it is a different story. Wealth management companies are constantly looking over their shoulders whether an Amazon or a Google are going to step into their terrain, change the status quo, and usurp the incumbents.

CB Insights has diligently chronicled the forays of Amazon into the financial services space.

Investor and Investment Shifts: Once upon a time, financial advisors, registered reps, and registered investment advisors have had access to more products than an average investor. Hence, selling high-margin, high-fee products was one of the ways the field force received compensation. And most products were actively managed. The index fund revolution and the subsequent ETF revolution have shifted the balance of power.

Also, customers who have long been happy to delegate money management to an advisor or a private banker are exerting more involvement, demanding more transparency, and dictating the product preferences.

From ETFs of every stripe and preference along with theme-driven bundles (Motif Investing, for example), high net worth customers are aware of and have access to all kinds of investments.

An accredited investor can participate in angel investments through a platform such as Angel.co. They can channel funds to social investment opportunities on Kiva. And acquire unlisted yet hot startup stocks on platforms such as Equidate or EquityZen.

Of course, the advice goes beyond managing investments. And that is where the wealth managers and private bankers differentiate and add value. Despite that, since AUM (Assets under Management) drives a lot of the revenue for wealth managers and their advisors, the shifting investor preferences and product innovations (particularly in the passive investing space) are driving down fee income.

Which Areas are Ripe for Digital Transformation in the Wealth Management Value Chain?

Wealth management in general and private banking, in particular, is a discipline steeped in tradition and decades of doing things a certain way. Today, with the digitalization revolution it is not just one or two areas of the wealth advisory value chain, but changes are necessary across the spectrum.

Digital and Cognitive Technologies across Wealth Value Chain:

- Acquiring Customers:

- Personalization technologies can tailor content to each user based on their digital trail, clickstream behavior, social footprints and other indicators.

- Digital analytics can intelligently segment the customers and match right advisors to the right prospects.

- KYC (Know Your Customer) and Profile Data:

- KYC is no longer about just compliance with regulatory mandates, but firms can procure much of the information through a divergent set of sources to reduce the data entry burden.

- Aggregation engines can compile data from diverse sources to pre-fill much of the profile information such as income, expenses, assets, and liabilities.

- Financial Planning:

- It is more than allocating buckets of assets notionally to different goals. Analytical and simulation engines can help plan, prioritize, and sequence goals, plan asset drawdown during the decumulation phase, and track goals on a real-time basis.

- Investment Management

- Dynamic asset allocation, tactical tilts, and optimal portfolio construction parameters are possible through cognitive technologies.

- Tax-aware rebalancing and right asset location and trading at other custodians are possible.

- Minimally disruptive portfolio transition from current state to desired asset allocation is easy a charm.

- Portfolio Oversight:

- Aggregation technologies, particularly those that leverage machine learning techniques, can extract and normalize information from unstructured documents from alternative investment managers and held-away assets to compile a holistic picture of clients’ finances.

- Trading:

- Intelligent routing of trade orders helps aid best execution

- Automated confirm matching reduces the pain of manual reconciliation

- Customer Goal Tracking and Ongoing Servicing:

- Automated ongoing advice generation based on internal, external, client specific and expected patterns.

- Actionable alerts spanning market, service, portfolio and operational needs

We are not suggesting that wealth management firms and private banking institutions offer these are direct to consumer service. Many of the ideas above can empower the advisors and provide them with actionable insights and intelligence.

Specific Wealth Management Applications to Address during the Digitalization:

- Account Opening: Digital account opening is an area that has witnessed a lot of innovation.

- Client Portals: Cohesive client portals with comprehensive functionality from initial research to ongoing service is a key enabler

- Financial Planning: Dynamic financial planning will become the norm, and real-time advice is the outcome.

- Advisor Workstations: Digital advisor workstations are going to drive advisor productivity, uniform advice, and automated ongoing advice generation.

- Portfolio Analysis and Asset allocation: Today, portfolio analysis and asset allocation technologies can take the core models and map to the individual preferences and priorities of clients and manage them in a mass customized model factory mode.

- Performance Measurement and Reporting: Performance is no longer a single metric. Wealth managers and Private Bankers are using risk metrics, risk-adjusted performance measures to reinforce the value addition of the firm and the advisors.

- Risk Management: Dynamic risk management at every level of the wealth advisory value chain is eminently possible.

- Customer Management: Crunching tons of data and tracking goals, markets, and personal events, digital technologies can empower advisors to render just in time valuable advice.

Core Digital Building Blocks for Wealth Management Firms and Private Banks:

- Cloud: Migration of key systems and processes to the cloud is a strategic imperative. Without an overarching cloud strategy and transition framework, wealth managers will be left to lurch in the legacy infrastructure which is not conducive to flexible scaling, and seamless transition to the next generation.

- Analytics: Analytics at every step and analytics of every stripe are the need of the hour for wealth managers and private bankers. Building the right analytics frameworks supported by appropriate technologies is a foundational imperative.

- Mobile: Today we live in a world dominated by smartphones and mobility. Mobile first should be the mantra driving the decision. Processes should support the touch paradigm.

- Social: Reaching out to customers and prospects in their natural social habitats and engaging with them in the right way will help wealth management companies drive customer satisfaction and retention.

- Collaboration: Collaboration technologies such as chat, text, video conferencing, co-browsing should become table stakes. In addition to fostering a diverse range of options and opportunities for client engagement, it will also allow peer-to-peer engagement and home office specialist collaboration.

Who should lead the Wealth Management Digital Transformation?

Digital transformation affects the very core of a company and determines the difference between surviving and thriving. Hence, as in other sectors, wealth managers and private banking firms need to rely on board level championship and C-suite leadership.

In addition to being the cheerleader, the CEO must involve himself/herself actively and drive the apex decisions.

Also, while business should drive the digital transformation, the alignment with and support of the information technology team is paramount. Typically, a digital business capabilities model will function as a bridge and a common language between business and technology.

Wealth managers should involve their advisory force as an integral part of the digital transformation endeavors. Otherwise, there will be hardly any buy-in and adoption challenges. The disillusionment could lead to advisor attrition and transition. In fact, some companies are reportedly paying their advisors to use new technology.

What are the benefits of digitalization of wealth management value chain?

- Growth Opportunities Optimization

- Better customer acquisition, reduced attrition, and higher satisfaction

- A consistent advice framework that supports the advisors and not varies based on the individual expertise, investing philosophy, and ethics.

- Business model flexibility – a combination of high touch and high tech based on client net worth, complexity, AUM, and relationship model.

- Ability to mass customize and launch more products cheaply and be able to appeal to the diverse tastes of customers in the long tail.

- Personalized content to meet needs of different generations of customers (and their heirs)

- Better risk management and compliance adherence through automated means

- Cost Minimization

- Reduced overhead

- Rationalization of physical retail presence

- Lower cost of delivery

- Chatbots and Self service shifting the burden from advisors and call centers

- Higher straight through processing

- The ability for advisors to handle more load reduces cost per client

- Lower compliance and risk management incidences

What are the metrics for the successful digital transformation of wealth management and private banking?

- Asset under management

- Revenue growth

- Advisor capacity – the number of clients and AUM

- Quality of advice

- Churn rate and attrition

- Client satisfaction

- Operating costs

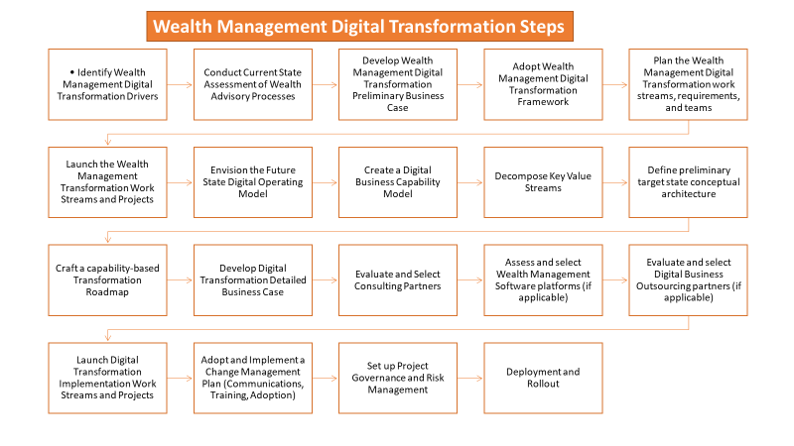

Next Steps for successful wealth management digital transformation:

- Assess your digital maturity

- Build a digital transformation business case

- Adopt a digital transformation framework

- Craft a cohesive and comprehensive digital capabilities roadmap

- Generate a sequential and incremental digital implementation plan

- Foster alignment and continuous engagement with stakeholders

- Establish a strong governance structure

- Launch the digital transformation program