ETF Proliferation – Overview of the Growth in ETFs

The landscape of the financial markets has witnessed a significant transformation with the advent and subsequent proliferation of Exchange-Traded Funds (ETFs). These investment vehicles, which bundle together various assets such as stocks, bonds, or commodities for investors to buy or sell on the exchange, have gained considerable traction. Since their inception in the early 1990s, ETFs have steadily become a preferred choice for both individual and institutional investors. This shift is due to their unique attributes, such as liquidity, flexibility, transparency, and ease of diversification, offering a compelling alternative to traditional mutual funds.

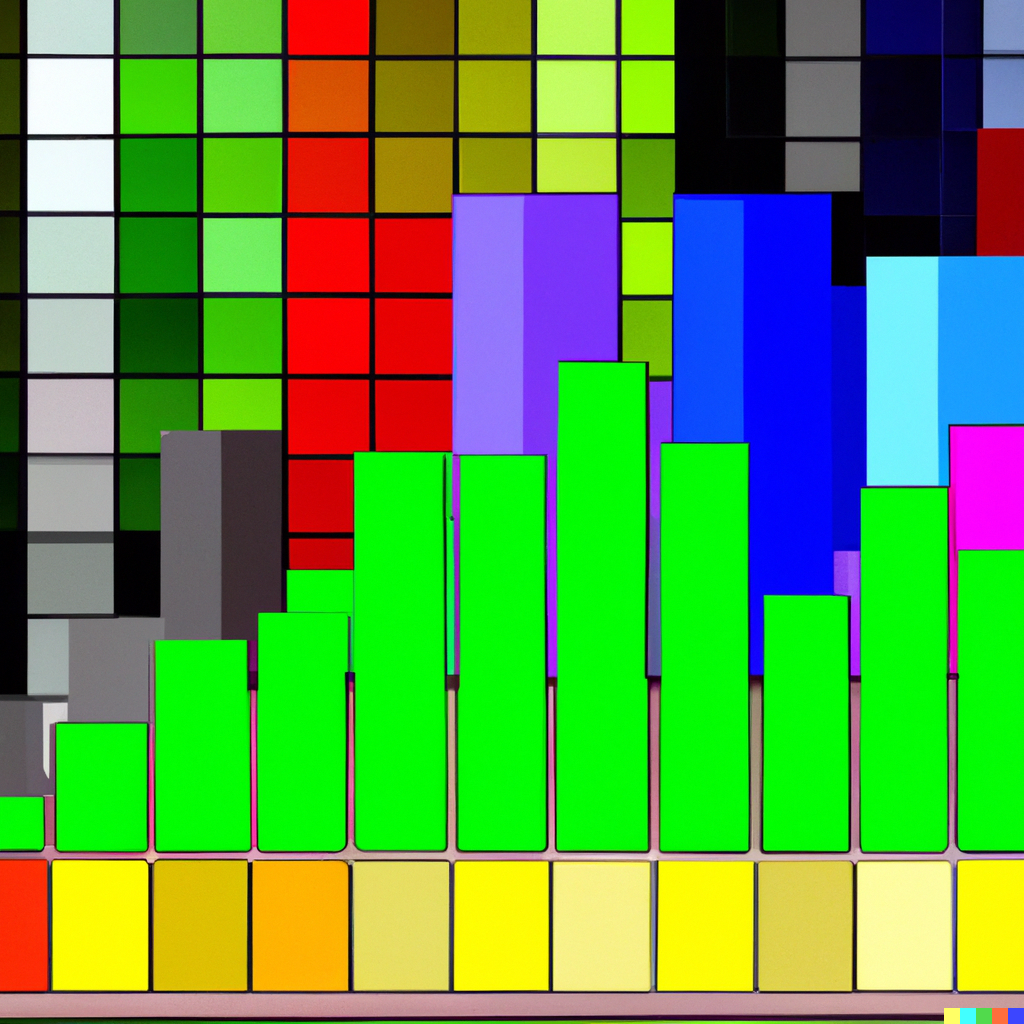

ETF numbers and Assets Under Management (AUM)

The growth story of ETFs is not only about their increasing popularity but also about their burgeoning numbers and the substantial value they manage. From just 123 ETFs in the United States in 2003, this number has impressively grown to a staggering 2,702 ETFs by 2022. The expansion reflects the rising demand from investors for innovative and tailored investment strategies. In tandem with this, the value of Assets Under Management (AUM) allocated to ETFs has witnessed a sharp increase. The AUM for ETFs, which stood at $151 billion in 2003, has skyrocketed to approximately $6.4 trillion in 2022, according to Statista. This exponential growth signifies the increasing confidence of investors in ETFs as a reliable and efficient investment tool.

Evaluating the Need, Value, and Implications of the Proliferation of ETFs

While the growth of ETFs stands as a testament to their rising importance in investment portfolios, it also raises pertinent questions. Do we need such a vast number of ETFs? What value are they bringing to investors? What are the implications of having so many ETFs of every stripe from various issuers? Moreover, as financial markets continue to evolve, what potential threats do emerging innovations like Direct Indexing pose to ETFs?

This post seeks to delve deep into these questions, offering an analytical and substantive exploration of the ETF landscape. Through a balanced perspective, it aims to provide senior executives in the financial services industry with valuable insights into the dynamics of the ETF market, its implications, and potential future trends. The post will scrutinize the current state of the ETF market, evaluate its benefits and drawbacks, and anticipate the possible effects of financial innovations. It intends to be a comprehensive guide for understanding the complex world of ETFs and their place in the evolving investment arena.

ETF Proliferation: Are There Too Many ETFs in the U.S.?

Supply and Demand Dynamics of the Current ETF Market

The enormous growth of ETFs in the U.S. directly reflects the robust interplay of supply and demand dynamics in the financial markets. On the supply side, financial institutions have been continuously launching new ETFs, aiming to meet investors’ evolving preferences and risk profiles. They offer products ranging from traditional, broad-based ETFs tracking major indices to niche, thematic ETFs catering to emerging sectors or unique investment themes.

On the demand side, investors’ growing appetite for ETFs seems insatiable. The allure of ETFs lies in their versatility. They offer the flexibility of stocks and the diversification benefits of mutual funds packaged into one. The ease of trading and the accessibility to a vast array of asset classes and sectors have contributed to their increasing popularity among both institutional and retail investors.

Investor Behavior and Appetite for Diversified Investment Options

Investor behavior has notably shifted recently, with a noticeable inclination towards more diversified and flexible investment options. As investors strive to optimize their portfolios to balance risks and returns, ETFs have become crucial for achieving this objective. They allow investors to gain exposure to a broad range of assets, industries, and even countries, all while maintaining liquidity and transparency.

Moreover, thematic ETFs cater to investors interested in investing in specific themes or sectors such as clean energy, blockchain technology, or e-commerce. These thematic ETFs have seen a surge in demand as they allow investors to conveniently invest in their areas of interest or conviction.

Market Saturation and Its Potential Impact

The burgeoning number of ETFs raises the question of market saturation. Are there too many ETFs for the market to absorb? While it may seem like there are an overwhelming number of ETFs, it’s crucial to understand that not all ETFs are created equal. The market heavily favors certain ETFs. Usually, they are the ones tracking major indices, as evidenced by their significant assets under management. In contrast, many ETFs have failed to attract substantial assets, indicating potential over-saturation in certain segments.

Over-saturation could lead to increased competition and pressure on fees, potentially impacting the profitability of ETF issuers. However, it also promotes innovation as issuers strive to differentiate their offerings. The impact on investors is a double-edged sword. While they benefit from a wider range of choices and lower costs, the plethora of options can also lead to confusion and complexity in decision-making. Understanding these dynamics will be critical for financial executives to navigate the increasingly crowded ETF landscape.

The Value Proposition of ETFs

Benefits and Value That ETFs Bring to Investors

Exchange-traded funds (ETFs) have become a mainstay of modern investment portfolios due to their unique blend of benefits. At their core, ETFs combine the best features of individual stocks and traditional mutual funds. Like stocks, ETFs are traded on an exchange, which allows investors to buy and sell them throughout the trading day at market prices. This provides significant flexibility and liquidity, a key advantage over traditional mutual funds, which only transact at the end of the trading day.

In addition to liquidity, ETFs offer transparency. They are required to disclose their holdings on a daily basis, allowing investors to know exactly what assets they own through the ETF. This level of transparency enables investors to make informed decisions about their investments.

Furthermore, most ETFs are passively managed, aiming to replicate the performance of a specific index rather than outperform it. This results in lower expense ratios compared to actively managed funds, leading to significant cost savings for investors over the long term.

ETFs‘ Role in Promoting Diversification

One of the most compelling aspects of ETFs is their access to a wide array of asset classes and sectors. ETFs cover practically every market segment, from broad market indices to specific sectors, from traditional assets like stocks and bonds to alternative assets like commodities or real estate. This allows investors to tailor their portfolios to their specific needs and risk tolerance.

Moreover, with the advent of thematic ETFs, investors can now gain exposure to emerging trends and sectors, such as clean energy, artificial intelligence, or electric vehicles, which may be difficult to access otherwise. This not only enables diversification but also allows investors to align their investments with their interests or beliefs.

The Significance of ETFs in Risk Management

ETFs play a pivotal role in risk management. As they provide exposure to a diverse set of securities, ETFs inherently help spread risk. Instead of investing in individual securities and being exposed to company-specific risks, investing in an ETF spreads the risk across many securities.

Additionally, sector and thematic ETFs allow investors to manage their risk exposure by choosing sectors that may perform well under certain market conditions or avoid sectors that they expect to perform poorly. This ability to fine-tune sector exposure is a powerful risk management tool.

Finally, certain types of ETFs, like inverse or leveraged ETFs, can be used as hedging tools. Inverse ETFs can help protect against market downturns, while leveraged ETFs can amplify returns, albeit at a higher level of risk.

In summary, the versatility and flexibility of ETFs make them an invaluable tool for investors, providing a powerful means to diversify, access various market segments, and manage risk.

Pros and Cons of ETF Proliferation

Benefits of a Large Number of ETFs

1. Enhanced Investor Choice

The proliferation of ETFs has led to an expanded universe of investment options, thereby enhancing investor choice. Investors can now access a wide array of asset classes, sectors, themes, and strategies through ETFs. Whether an investor wants exposure to a broad market index, a specific sector, a niche theme, or a complex investment strategy, there’s likely an ETF for that.

2. Increased Market Competition

The surge in the number of ETFs has fostered increased competition among ETF issuers. This competition has driven innovation in product offerings, leading to the development of ETFs that track unique indices, target specific investment themes, or offer new ways to manage risk.

3. Lower Fees

Competition among ETF issuers has also put downward pressure on expense ratios. Lower fees benefit investors by reducing the cost of investing, which can enhance net returns over time.

4. Greater Market Segmentation

The proliferation of ETFs has led to greater market segmentation. ETFs now offer targeted exposure to various market segments, allowing investors to tailor their portfolios to their specific investment objectives and risk tolerance.

Drawbacks of ETF Proliferation

1. Potential for Investor Confusion

While having a wide array of ETFs provides investors with many options, it can also lead to confusion. Investors may find it challenging to navigate the ETF landscape, understand the differences between various ETFs, and select the ones that best suit their investment goals.

2. Concerns Over Liquidity of Less Popular ETFs

Not all ETFs attract a large volume of trading activity. Less popular or niche ETFs may suffer from low liquidity, which can lead to wider bid-ask spreads, potentially impacting the cost of trading these ETFs.

3. Regulatory Challenges

As the number of ETFs grows, so does the complexity of overseeing and regulating this market. Regulators face challenges in ensuring transparency, preventing market manipulation, and protecting investors, especially given the rapid innovation and diversification in the ETF industry.

4. Risk of Over-Diversification

While diversification is generally beneficial, investors risk becoming over-diversified by investing in too many ETFs that overlap with their holdings. Over-diversification could dilute potential gains and lead to mediocre performance that merely tracks the market. Investors need to understand the underlying assets in each ETF and ensure they achieve the desired level of diversification.

The Threat of Direct Indexing to ETFs

Direct Indexing and Its Rise

Direct indexing is an investment strategy that involves buying individual securities in an index rather than using a fund like an ETF or mutual fund to replicate the index’s performance. Advances in technology and reduced trading costs have made this strategy more accessible to a wider range of investors.

The rise of direct indexing is attributed to its potential for customization. Unlike ETFs, which have a fixed set of holdings, direct indexing allows investors to modify the constituents of their index-based portfolio. For instance, investors can exclude certain companies or sectors based on personal beliefs or tax optimization strategies.

Comparisons Between ETFs and Direct Indexing: Advantages and Disadvantages

Direct indexing offers several advantages over ETFs. One of the most significant is the ability to personalize the investment strategy. Investors can tailor their index-based portfolio to align with their values, preferences, and tax situation.

Direct indexing also provides tax advantages. Investors can use tax-loss harvesting strategies at the individual security level to offset capital gains, which can improve after-tax returns.

However, ETFs offer certain advantages that direct indexing does not. ETFs, especially those tracking broad-based indices, are highly liquid, making them easy to trade. In contrast, some securities within a direct index might be less liquid, making them harder to buy or sell without impacting the price.

Furthermore, managing a direct index portfolio can be complex and time-consuming, as it requires managing potentially hundreds of individual securities. This can make ETFs a more convenient option for many investors.

Potential of Direct Indexing to Replace or Diminish the Role of ETFs

While direct indexing has certain advantages over ETFs, it is unlikely to replace ETFs completely. For one, ETFs’ simplicity, convenience, and liquidity make them an attractive choice for many investors, especially retail investors.

In addition, while direct indexing allows for customization, this feature is most beneficial to investors with large portfolios who can spread the transaction costs over many securities. For smaller investors, the cost advantages of ETFs, especially those with low expense ratios, may outweigh the benefits of direct indexing.

Therefore, it’s more likely that direct indexing will coexist with ETFs, serving different needs of different types of investors. Instead of viewing direct indexing as a threat to ETFs, it could be seen as an evolution of index investing, offering another tool for investors to achieve their financial goals.

Wrapping up the discussion of ETF Proliferation

The rise of ETFs has been a transformative trend in the investment world, creating a vast landscape of opportunities for investors to diversify their portfolios, access various asset classes, and manage risk. The explosion in the number of ETFs in the U.S., while offering enhanced choice and competition, has also brought its own set of challenges, such as potential investor confusion and regulatory complexities. The advent of direct indexing presents another dimension to the evolution of index investing, with its benefits of customization and potential tax advantages.

Predictions and Recommendations

Given the growing demand and the continuous innovation in the ETF space, it is likely that ETFs will remain a dominant investment vehicle. Financial service providers should focus on understanding the evolving needs of investors and aligning their ETF offerings to meet those needs. Moreover, they should also be prepared to navigate the potential regulatory changes that may arise due to the proliferation of ETFs and the growth of direct indexing.

Given the increasing complexity and diversity in the ETF market, the industry must also focus on investor education. Helping investors understand the nuances of various ETFs will be essential to ensure they make informed investment decisions.

A Word to ETF Sponsors

For ETF sponsors, the increasingly crowded ETF landscape calls for carefully evaluating their product offerings. Sponsors should assess their product line’s value proposition, ensuring they offer ETFs that serve investors’ unique needs or purposes.

Innovation should remain a key focus, but it should not come at the expense of complexity that could lead to investor confusion. Ensuring transparency and clarity about the risks and rewards of their ETFs will be critical.

Finally, given the rise of direct indexing, ETF sponsors should consider ways to integrate customizable features into their offerings or explore opportunities in the direct indexing space. While direct indexing may not replace ETFs, it represents a growing market segment that ETF sponsors should not ignore.